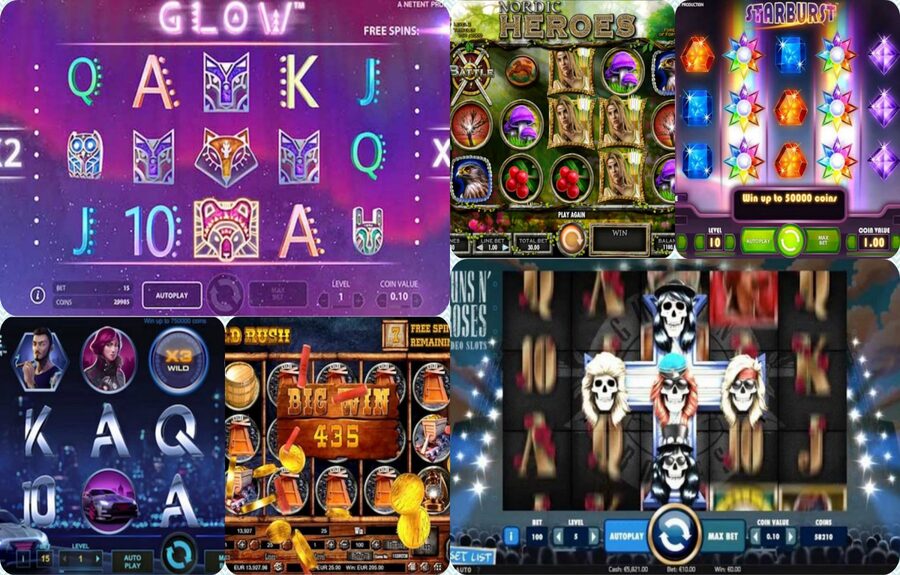

안전놀이터: 게임의 세계를 더 안전하게!

안전놀이터란? 안전놀이터는 사용자들에게 신뢰할 수 있는 토토사이트를 추천하고, 검증된 업체들을 소개하는 플랫폼입니다. 이곳에서는 다양한 업체들의 정보, 사용자 리뷰, 그리고 빅데이터를 기반으로 한 순위 등을 제공하여 사용자들이 안심하고 게임을 즐길 수 있는 환경을 조성합니다. 토토친구 플랫폼의 역할 토토친구는 사용자들이 안전하게 토토사이트를 이용할 수 있도록 돕는 서비스입니다. 이 플랫폼은 각 사이트의 신뢰도,...